The peculiarities associated with a company's sector may determine how much asset turnover ratio it produces. It's essential to understand that asset turnover ratios can vary significantly between separate industries. The company's investment in its asset base is at a level that it can maintain.ĭoes a company's industry impact its asset turnover ratio? The company can navigate through unforeseen economic circumstances like increased competition. The company generates enough income from its asset base. The company keeps a proper inventory of its assets and sales and can make accurate calculations. The company produces a supply matching the demand for its product or service. There are several reasons a company may have a high asset turnover ratio. For example, if you want to find out the turnover ratio for one month, you may calculate the turnover ratio for a year and divide the value by twelve. Generally, the asset turnover ratio heavily depends on time. They can calculate it based on a shorter or longer period where necessary. Typically, companies calculate the total asset turnover ratio per year. A high ratio value often indicates that the company is effectively using its assets. The ratio differs across various industries. What makes for a high asset turnover ratio?Īccountants and evaluators typically use the asset turnover ratio as an economic measure to determine which company performs better financially. Then you can divide the total sales by the average asset value of the trading year using the asset turnover formula. It can also appear as total revenue on the company's income statement. You can start by obtaining the value of the total sales made by the company for that trading year and make the necessary deductions.

TOTAL ASSETS TURNOVER RATIO FORMULA HOW TO

Related: A Guide on How to Calculate Total Assets (With Examples) 3. A company's balance sheet may inform the average value of assets maintained over an accounting period. The new value obtained is the average value of the company's assets for a year. You can sum up both values and divide them by two. Obtain the average value of the company's assets These can be tangible items, such as vehicles, buildings and furniture, or they can be intangible items, such as intellectual property. A business asset is an item of value owned by a company. You can access this information on the company's balance sheet. Typically, the first step is getting the values of the organization's assets at the beginning of the trading year and at the end of the trading year. There are five steps involved in calculating the asset turnover ratio. Related: How to Calculate Net Income for an Individual and a Business Organization How to calculate asset turnover ratio

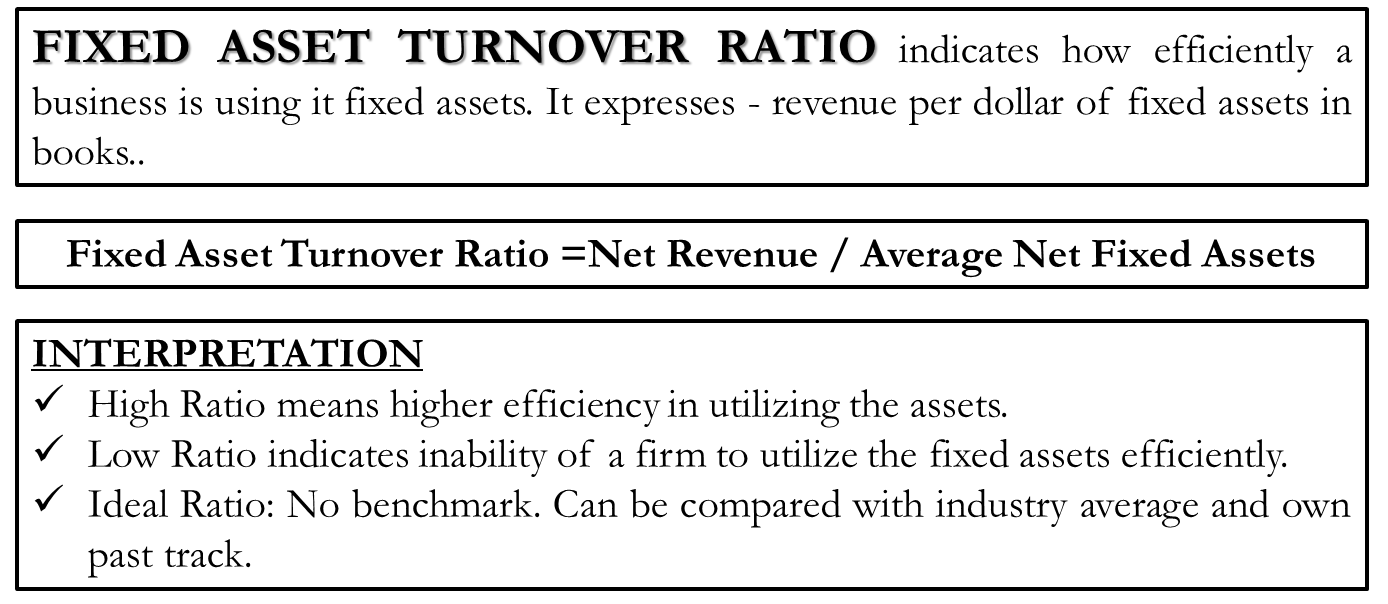

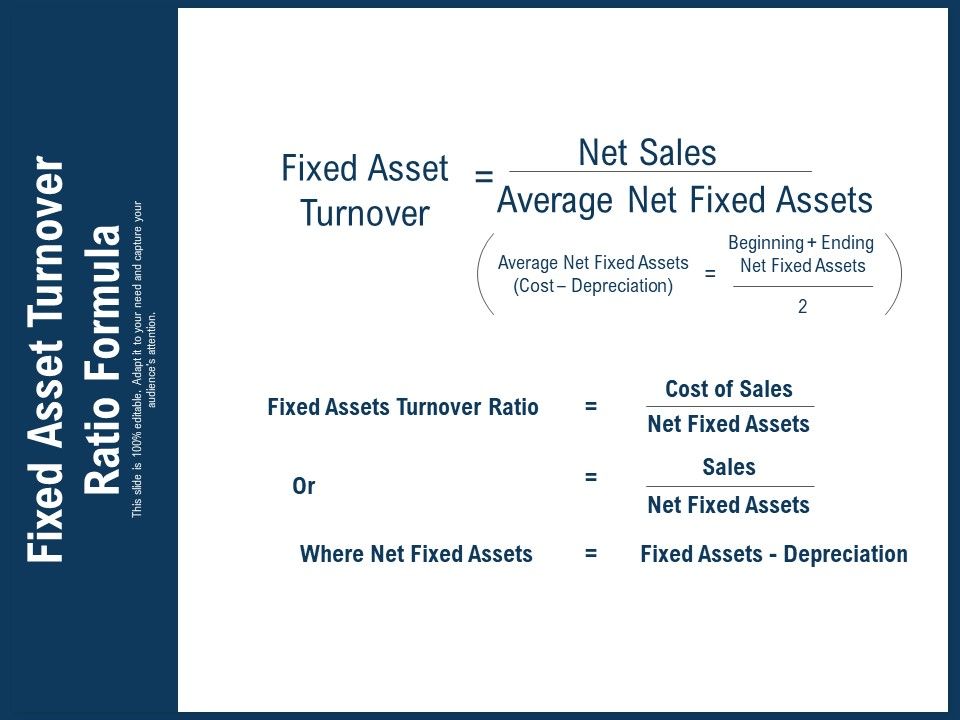

Net sales: This is the amount of income generated by the company after making deductions, such as sales tax, sales returns, sales discounts and sales allowances.Īverage total assets: This is the average of all assets the company owned at the beginning and end of the fiscal year. In this formula, the elements can read as follows: Here is the formula to calculate an asset turnover:Īsset turnover ratio = net sales / average total assets

This ratio is often a significant indicator of how well the company uses its assets to generate income. An asset turnover ratio, also called the total asset turnover ratio, is an efficiency ratio that compares the value of a company's sales income to its total asset value. The asset turnover formula is the mathematical rule used to calculate a total asset turnover ratio.

In this article, we learn what the asset turnover formula is and how to calculate it, discuss what makes for a good ratio and how industries affect companies' ratios and review an example of asset turnover ratio estimation. An asset turnover ratio can help you evaluate how well a company uses its assets to generate income. The company's working capital refers to the total revenue flow and the assets the company uses to cover the operational cost. One factor that may influence the success of a company is the amount of working capital it can access. There is also text on the whiteboard that reads "Asset turnover ratio = total sales/average total assets" There is a woman sitting in a wheelchair writing on a whiteboard.

0 kommentar(er)

0 kommentar(er)